Today, Kleinrock reported that the estate tax repeal effort may not be dead. Specifically, it reported that "Senate Majority Leader Bill Frist (R-TN) [whose brother's family will benefit to the tune of a half a billion dollars from estate tax repeal--ed.] is looking for a legislative vehicle in which to attach his initiative [to repeal the estate tax] and get it through Congress. Currently, the top candidate is the pension reform bill."

Also today,

TaxProf had links to two position papers on the estate tax.

The first was Neil H. Buchanan's paper

The JEC’s Estate Tax Report: Myths and Legends, 111 Tax Notes 1133 (6/5/06). In that paper, Buchanan takes on the oft-repeated baloney of the JEC that the estate tax threatens small businesses. He shatters the argument, concluding:

[T]he closest thing that the JEC has to a credible source regarding the "burdens" of the estate tax cannot rule out the possibility that heirs are able to pay estate taxes if they want to hold onto the family business. The economists who wrote the study even suggest that business owners might not care enough to do all they can to keep the business in the family. The latter possibility means that, even if we do someday find evidence of businesses that were "busted up" by the estate tax, we cannot be sure that was even a bad result from the standpoint of the decedent.

Buchanan notes three other arguments that the JEC frequently drags out in support of repeal. One of those is that the estate tax has reduced the stock of capital in the country by approximately $847 million. He characterizes this argument as being "highly suspect."

Lo' and behold, TaxProf also links to a new missive from the JEC,

Reconsidering the True Revenue Yield of the Estate Tax. In that report, the JEC contends that "[a] study from the U.S. Treasury Department found that "estate taxes have a dampening effect on the reported size of taxable estates," reducing reported estate sizes by 14 percent." The report itself does not provide any citation or link to the study, but a quick Google search located it

here. The study, literally, reaches the precise conclusion that the JEC reports, but that conclusion does not apply to the current estate tax. Why?

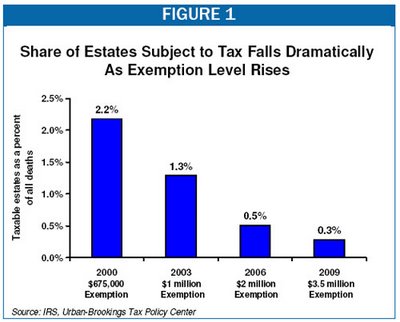

By its terms, the study "explored the effects of estate taxation on bequests using time series data for the period 1948 through 2000." Thus, the percentage of estates subject to the estate tax was significantly higher than it is today.

Furthermore, the report explicitly denies the its conclusion supports the implication that the JEC would read into it, namely that wealth is being diminished as a result of the estate tax. Thus, the report states, "As with much of the work on the taxable income elasticity,

it is not clear whether this measures the effects on saving and wealth accumulation, or reflects tax avoidance." (Emphasis added.)

Buchanan notes that JEC reports have a "cover page, with the title of the report above an American eagle seal and [JEC Chair Jim] Saxton's name." Too bad they lack any intellectual honesty.